Wealth Transfer

Like most retirees you have probably accumulated a large portion of your assets in one or more of the following types of accounts:

- Non-qualified annuities

- IRAs

- 401(k)s

- Pension Plans

At some point along your retirement journey there may come a time when you earmark a portion or all of these assets for legacy purposes. Most people tend to leave these accounts in their existing products until they pass away. Unfortunately, this could create an unnecessary tax liability for your beneficiaries. At distribution of these assets your beneficiaries must report any proceeds received at their income tax bracket. This could push their total tax bill to over 30% and possibly even higher depending on future tax rates and the size of your estate.

There may be a better strategy available to you called The Qualified Money Solution. The Qualified Money Solution is a simple and easy way to transfer assets to your beneficiaries, provide benefits to you if you ever require extended care, and offer you flexibility for future guaranteed income payments.

What Does the Qualified Money Solution Do? |

How Does the Qualified Money Solution Work? |

The annuity product used in examples refers to ATHENE Benefti 10SM with Enhanced Benefit Rider issued by Athene Annuity & Life Assurance Company, Wilmington, DE. Contract contains exclusions, limitations and charges. Please see product brochure for details. Rates and features are subject to change without notice. State variations may apply. The life product used in examples refers to Generation Legacy issued by Baltimore Life Insurance Company, Baltimore, MD. Contract contains exclusions, limitations, and charges. Please see product brochure for details. Rates and features are subject to change without notice. State variations may apply.Examples shown are subject to change and are not an offer or contract.

Is Your Retirement Secure?

Things To Consider: |

||

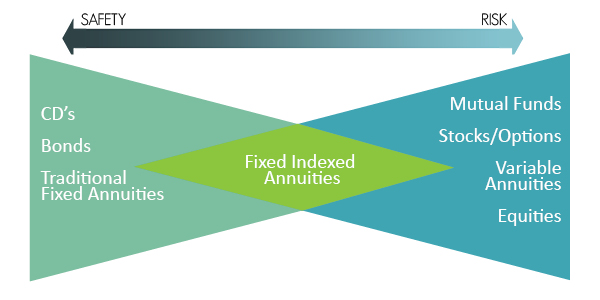

Principal 100% protected from Stock Market volatility Rates are typically guaranteed Term is guaranteed Penalties for early withdrawal Low Interest Rates |

Principal 100% protected from Stock Market volatility Guaranteed Minimum Interest Rate offered Offers a bonus that immediately increases the asset’s value Links to Stock Market for higher gains potential Locks in gains each and every year Guaranteed Lifetime Income Riders offer high growth rates for future income |

Principal is NOT protected Higher potential of gains Typically very liquid Cannot guarantee |

| Potential Returns 1-4% |

Potential Returns 0-15% |

Potential Returns -40% ? +40% |

RMD Basics

RMDs are not just an IRS rule – they are an integral part of your financial retirement plan. RMDs can be used to supplement retirement income, can be reinvested in your accounts, or can be leveraged for your beneficiaries. Before we discuss those strategies let’s review the basics of RMDs.

For educational purposes only. This guide should not be considered tax, legal, or investment advice. Such advice should be sought from professionals licensed in those fields.